OK, so, streaming has a churn problem...

Analyzing the data – Defining the problem – Coming up with a solution

In the post below, Rameez and Reid team up to dive into recent trends in churn for leading streaming services.

Part I: Making sense of the data

Streaming has a churn problem

Antenna published its latest State of Subscriptions report earlier this month. The big picture takeaways:

Churn Rates for the streaming category have tripled in the past 4 years.

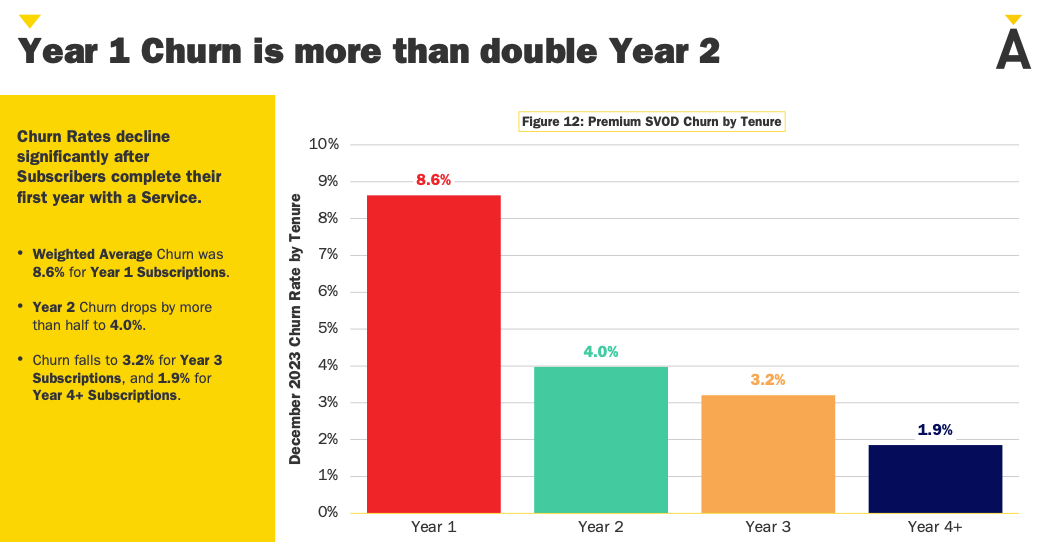

Churn Rates amongst newer subscribers (i.e. in the first year of their relationship with a service) are much higher (more than double!) than long-term Churn Rates.

As new services enter the market to compete, their Subscriber bases consist of newer, less-loyal subscribers.

Hence, the industry has a churn problem.

Popular opinion is that these businesses can’t survive with this level of churn. After all, with a 6% monthly churn rate, you lose over half of your subscribers each year. That does not make for a great business. While it’s hard to argue with this line of reasoning — higher churn is worse — it’s also profoundly unhelpful to operators of these businesses.

Antenna observes that streaming Churn Rates decrease meaningfully for more loyal subscribers: Churn Rates for Subscribers who have been with a service for 4+ years are almost 5X better than those in their first year. So the question is how do we get more loyal subscribers and what do we do with those loyal subscribers?

Double click: churn rates can be misleading

It’s important to be aware of the limitations of using churn rates to evaluate how well a product is keeping its customers (i.e., retention).

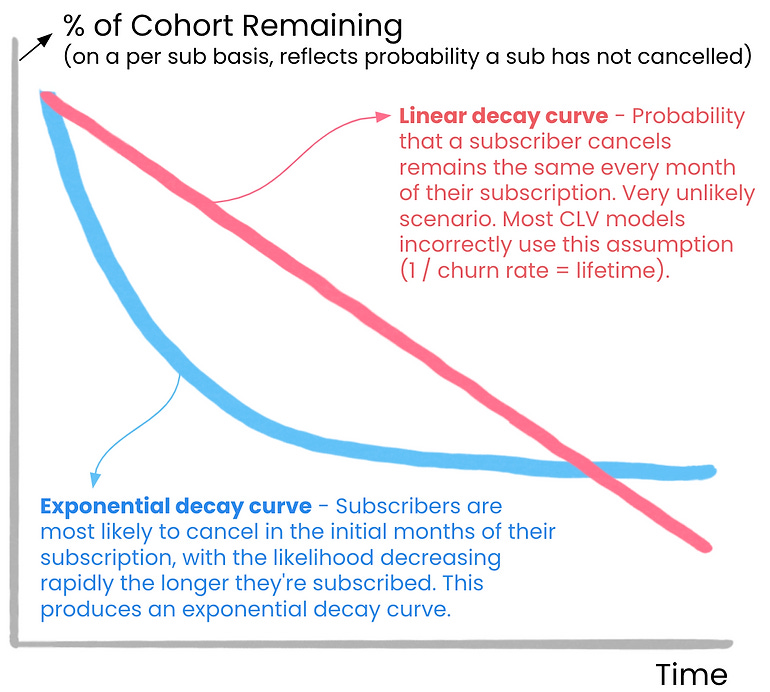

First, it’s important to understand that subscribers are most likely to cancel earlier in their subscription, and the likelihood of canceling decreases rapidly the longer someone stays subscribed. In other words, the probability that a paying subscriber will cancel decreases exponentially, not linearly, over time:

So how does this impact churn rate?

When a business first launches or grows rapidly, there will be an influx of new paid subscribers. Since these new subscribers are more likely to cancel, these periods of step-function growth will increase churn rate.

Said another way, we should expect churn rate to naturally decline over time as the average tenure of subscribers extends. This is why the gradual increase in churn rate for Netflix over the past few years is somewhat concerning.

But here’s the kicker: just because churn rate is going down doesn’t mean we’re getting better at retaining our subscribers. Churn rate is totally independent from trends in customer lifetime value (“CLV”), which tells us how much money we’re making from a subscriber over time.

Operators, investors, and executives should care about the two ways to drive growth for subscription businesses:

Growing the number of paid customers.

Increasing the value of those paid customers (i.e., customer lifetime value, “CLV”).

Cohort-based retention rates are the backbone of customer lifetime value and are, by far, the best way to evaluate how well a business is keeping its customers.

To go much deeper on the limitations of churn rate, check out Reid’s original post here.

How to identify loyal subscribers

The problem originates from an overly simplified definition of success. For years, streaming services have guided stakeholders to focus on total Subscribers (and growth rates), without a nuanced perspective on CLV. We’ve reached a point in the industry lifecycle where this must change ASAP. We need metrics that highlight not only whether a service is growing its paid customers but also whether it is increasing the value of those paid customers — with clearer segmentation between ‘good’ and ‘bad’ users.

The first step is to segment LOYAL vs. CASUAL subscribers. Most Streaming services report KPIs that completely mask the difference in behavior between these two groups, such as: Subscribers, Subscriber Growth, ARPU, ARPU by Geography.

Based on Reid’s experience in the streaming world, here are a few metrics that can help segment loyal vs. casual subscribers:

Tenure (total lifetime paid months and uninterrupted subscription paid months)

Depth (hours watched per month)

Diversity (series watched, genres watched)

Frequency (sessions, active days)

Devices (living room and/or mobile and/or desktop)

For a crash course on how Reid used these variables to drive retention at Hulu, HBO Max, and Crunchyroll make sure to read this full post.

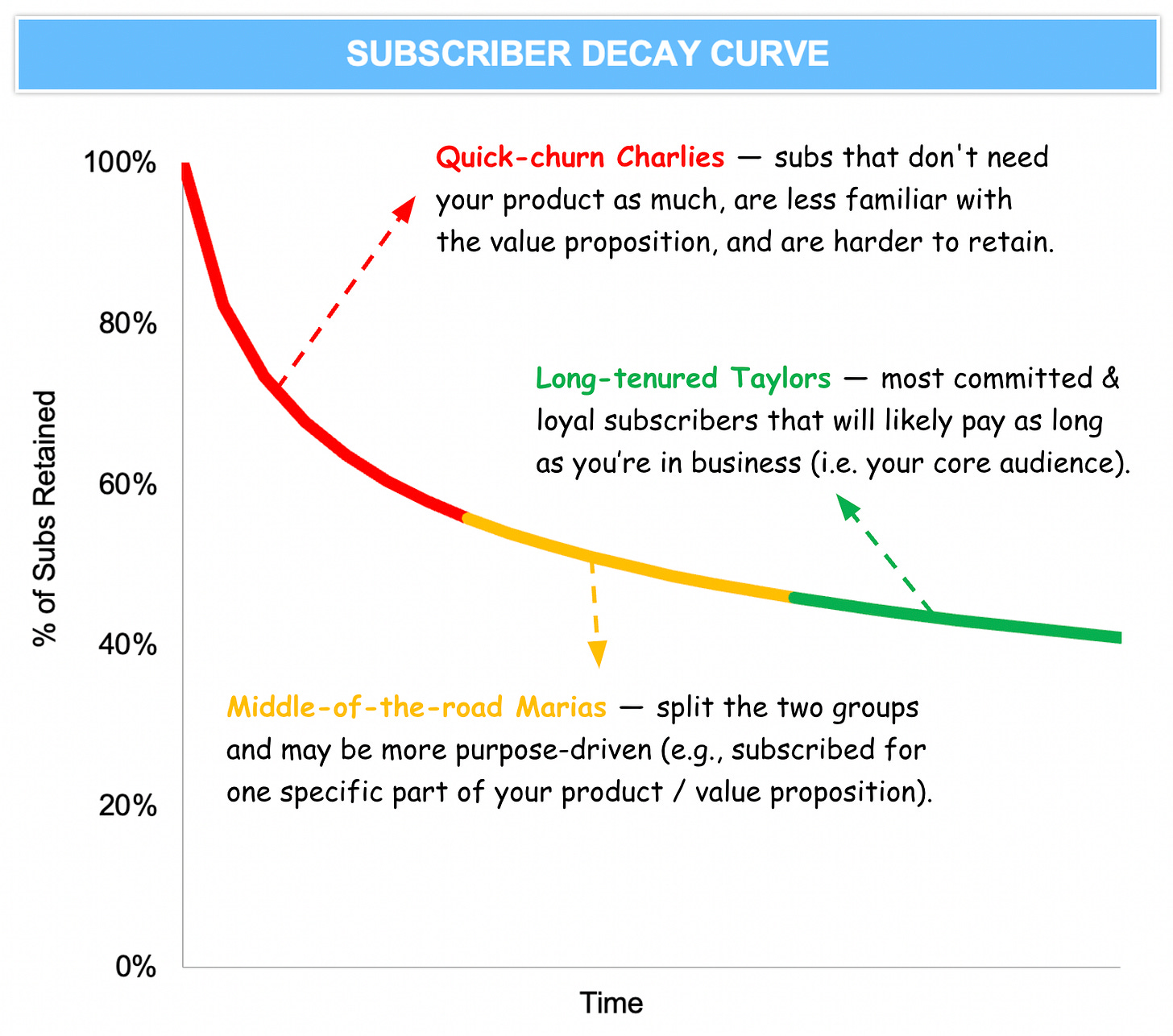

We can also build different customer personas based on past retention data. For example, the image below shows three hypothetical personas:

Quick-churn Charlie’s: subscribers with less desire who usually cancel in the first few months after subscribing (e.g. binge-watching a single series or coming for a specific show and canceling once the season ends).

Long-tenured Taylor’s: subscribers who absolutely love your product and will never cancel.

Middle-of-the-road Maria’s: subscribers that split the two groups above and resemble your average subscriber. (e.g. have some trust in your brand and will watch most new shows, but might cancel when there’s a dearth of new shows or movies).

This type of segmentation helps teams understand who is driving fluctuations in CLV and allows them to focus their efforts in more targeted ways. Focusing on improving new subscriber onboarding will hopefully turn more QC-Charlies into MOTR-Marias. Launching new products or emphasizing higher-priced subscriptions hopefully grows CLV by increasing ARPU for LT-Taylors.

Perhaps one day, leading subscription businesses will report on CLV by persona so the world can actually tease out the drivers of their success — hey, a boy can dream!

Part II: Solving the problem

The first phase of the streaming wars was defined by a relentless pursuit of subscriber acquisition and unsustainable spending. The next phase will focus on sustainable investments, improving retention, increasing revenue per subscriber, and boosting customer lifetime value.

In this next phase, investors, operators, and executives need a new suite of KPIs and mental models for evaluating a different type of growth. Further, teams will need to be encouraged to focus on new features and efforts aimed at increasing CLV.

Let’s explore ways teams can reorient their focus on increasing CLV.

Surveys

A great starting point is asking paid subscribers to fill out a survey, paying close attention to responses from the most engaged and longest-tenured subscribers. The goal is to develop a deep understanding of why people buy your product.

Cancel surveys can also be a treasure chest of feedback and a vital ingredient when trying to improve retention. Responses are usually candid and come from folks who paid for your product but weren’t satisfied.

Equipped with a better understanding of why subs are paying (or canceling), teams can explore ways to double down on delivering more value to improve retention. They can also improve the value prop and pricing of higher-priced tiers, encouraging more subscribers to upgrade.

Subscription tiers

One of the best ways to increase ARPU is to get more subscribers on a higher-priced subscription tier. Netflix has continued to expand its subscription tiers, each aimed at different segments of subscribers.

Netflix avoids windowing shows or movies to a specific tier, instead leaning on product elements to differentiate subscription tiers (e.g., streaming quality, concurrent views, device downloading, spatial audio). Niche services have shown there are a wide variety of value to provide superfans in higher-priced tiers:

Digital badges or status symbols (see Twitch for inspiration)

Shoutouts or "producer credits"

VIP treatment or exclusive invites to events (in-person & virtual)

Member-only merch and other physical products

Behind-the-scenes content

For mass media, the opportunity for higher-priced tiers likely centers on allowing fans to dive deeper into shows and movies they love. Netflix seems to be making a substantial investment in gaming, which will likely serve as a meaningful driver of retention and value in higher-priced tiers. Similarly, Disney has indicated it may eventually link Disney+ subscriptions to its theme parks.

Introduce other products

Another way to increase ARPU is to introduce new products outside subscriptions, supported by sponsorships or direct payments from the audience. While Reid was at Crunchyroll, they launched several new products aimed at deepening their relationship with fans and growing ARPU:

Hosting live events like Crunchyroll Expo, Anime Awards, and theatrical screenings.

Building the Crunchyroll Store, allowing fans to buy figurines, merch, DVD specials, and manga for their favorite shows.

Creating Crunchyroll Games, a game publisher of anime-based mobile games.

Producing in-house podcasts and shows, including quirky holiday specials that we ran on late-night television.

Again, since most mass media brands don’t pass the t-shirt test, they may need to lean on shows, movies, or any owned IP when launching new products.

Improving retention

Tactically, there can be quite a bit of overlap between efforts aimed at increasing ARPU and improving retention — both have the essential ingredient of delivering more value to your core customers.

Here are a few broad themes to consider in terms of improving retention:

Community-strengthening features (e.g., status, inside jokes) to encourage loyalty.

Healthy habit-forming features (e.g., goals, streaks) to help folks reach their goals through your product.

Improving onboarding to connect new subscribers to the value of your product.

Battling credit card failures to reduce involuntary, payment-related cancels.

Optimizing the cancel flow, improving lifecycle messaging, and encouraging annual plans without harming the user experience.

The bottom line

None of these strategies are novel! In fact, many of them come from our past experiences. The hard part is for the industry to (a) admit it has somewhat of a problem and (b) select better KPIs to optimize against. Once the incentives are in place, the focus becomes execution and empowering experts that can bring the playbook to bear.

The first phase of the streaming wars was marked by a land grab and subscriber acquisition at all costs. The next wave will be marked by a CLV-centric view of growth, defined by creative and innovative ways to deliver more value to subscribers.