What role will Streaming play in the new media ecosystem?

Audience Funnels — Top, Middle, and Bottom of Funnel — and Streaming's Future

Disclaimer: Rameez is a Co-Founder of Antenna, a subscription analytics firm. The views below are Rameez’s views and do not necessarily represent the views of Antenna. Note: while terminology is debated, for this blog post, when I refer to “Streaming”, I am referring to VOD services that have at least some paid consumer subscription element.

In the wake of COVID shelter-in-place mandates, Video Streaming absolutely exploded. Disney+ (and Apple TV+) launched in November 2019 and, since then, every single one of the ensuing 14 quarters have produced more Premium Entertainment SVOD Gross Adds than recorded in Q3’19, the quarter prior to the Disney+ launch. Streaming bulls were quick to profess the immediate death of the cable bundle. It seemed like everyone had to have their Plus or Max.

And then, in Q2’22, Netflix posted its first Subscriber loss, losing 970,000 Subscribers. What felt like overnight, the bulls turned to bears. After all, streaming had not achieved its potential and it was now clear that the addressable market was smaller than originally imagined. It followed that streaming was not only not the future, it was actually DOA, a flawed business model that could not work. Right..?

Streaming’s future

Alas, death, taxes, and the Gartner hype cycle are the only certainties in life. But, as in most cases, the truth lies somewhere in between; it’s never as good or bad as the optimists or pessimists, respectively, profess.

I argue that the key to understanding the success of Streaming to date, as well as its future potential, it is most important to understand what role it plays in the media ecosystem. More generally, what role does paid, premium, lean-forward programming play in a media ecosystem?

Audience Funnels & Monetization

The Audience Funnel is the best way to analyze any media business in the digital world. A classic marketing funnel consists of ~3 stages: top, middle, and bottom. We can easily adapt this funnel for the Media use case: assume that there are more top-of-funnel users (ToFu) but they have lower intent & willingness to pay than bottom-of-funnel users (BoFu), and vice versa.

For media companies, there are generally 2 principal laws of the Audience Funnel:

The ultimate objective of any media company should be to attract as many users as possible to the ToFu, and funnel them all the way down to BoFu, via a series of higher intent products. Each layer of the funnel can effectively be thought of as marketing to convince users to convert to the next.

The size of the audience (TAM) and their willingness to pay (ARPU) are usually inverted. In other words, while there are a lot of users at the ToFu, it’s hard to charge them $9.99 — but the few BoFu users would gladly pay $999. There are discrete ways to monetize each layer of the funnel. You don’t just charge every layer a monthly subscription.

The way to win as a media company in the internet age is to master the Audience Funnel and its corresponding monetization strategies at each layer.

Streaming: ToFu, MoFu, or BoFu?

To answer the original question, what role does streaming play? To my eyes, the answer is pretty clear. Streaming is a MoFu product: it has a large, but not unlimited addressable market given its premium, lean-forward product and affordable-yet-meaningful price point. In other words, there are lower intent products with more users that are free, lean-back experiences — and there are higher intent products with fewer users such as visiting a theme park.

A common truism these days goes something like this: “Netflix only had 75 million UCAN Subscribers; in order for streaming to work it would need to be 100s of millions; Streaming is doomed.” Well, hold on a second. Another way of looking at this: for a MoFu product, it is actually astounding that Netflix has 75 million Subscribers at $16 per user. With a proper ToFu (and BoFu) product & monetization strategy, imagine where this thing could go, both in terms of # of users and revenue!

Building the ToFu to complement the MoFu

While it may not be the most urgent question for any given Streaming service, I believe the most existential question is how do we build the ToFu to convert to our existing MoFu product?

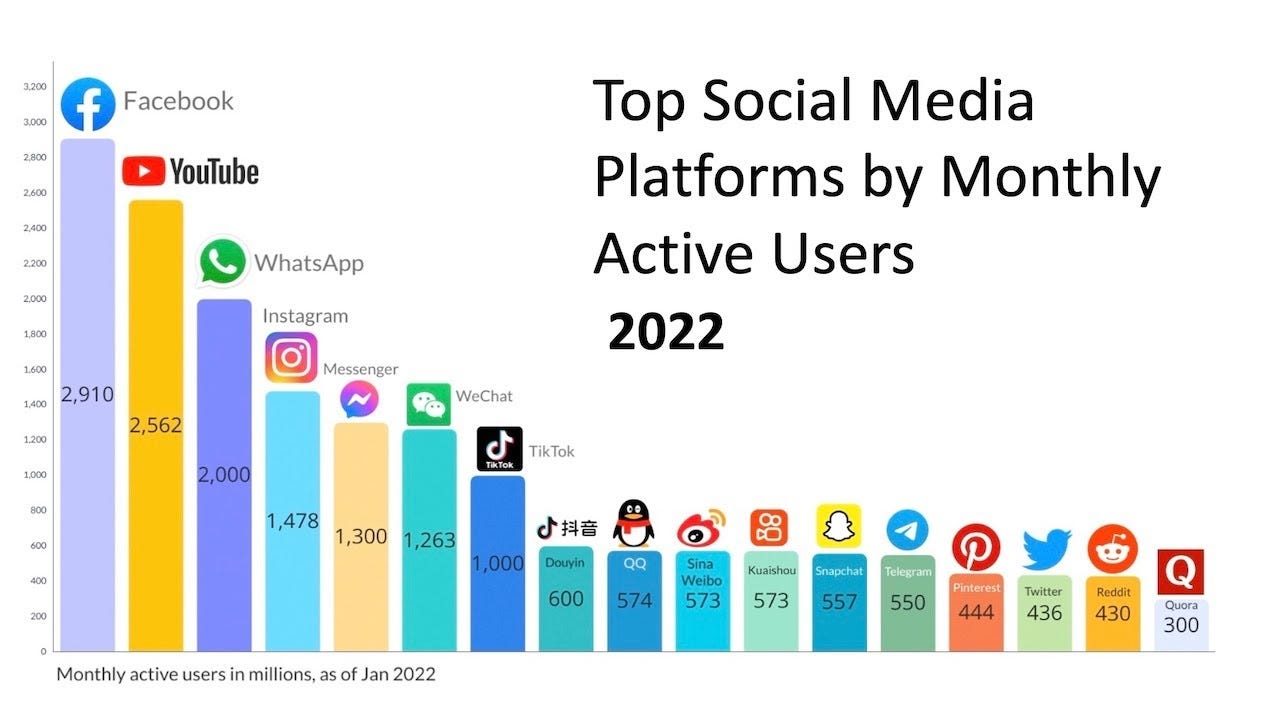

Why is this so important? ToFu products serve to build brand awareness, reach mass audience, and serve as the key conversion funnel for those more premium, lower funnel products. Case in point: the free service, YouTube. While there’s an open debate about whether Netflix can reach 250 million global users, YouTube’s global MAU figures are 10X that.

So, how do we connect these independent parts of the funnel? There are currently three viable ToFu products. Each of them sit on a continuum between raw audience scale and relevance to streaming. In other words, having a lot of users is really helpful, and so is having users that are uniquely relevant to the MoFu product you want to convert them to, but often scale & relevance are inversely correlated. For this vertical integration between layers of the funnel to work well, relevance is key to driving conversion.

Big tech / Social media, generally: Companies like Facebook have huge user bases. Certainly, it’s possible some portion of those user bases could be converted to Streaming. But, relative to the second and third alternatives on this list, the relevance to Streaming is lowest.

YouTube: YouTube lends itself quite nicely to Streaming given it’s all about watching long-form video content. And while it’s not as large as the Facebook family of apps, it is still massive. Given the organic connection between the consumption patterns of YouTube and Streaming, and its scale, YouTube is a pretty attractive ToFu.

Free Ad-supported TV (FASTs): FASTs – the free stuff you see when you turn on your smart TV; generally re-runs of some old sitcom – are 2023’s most relevant answer to the ToFu for Streaming. This experience offers the exact same mode of media as Streaming does, for free, albeit at a much lower quality bar. And while it doesn’t have the potential scale of YouTube, it’s addressable market is still quite large (~100% of smart TV owners), and the relevance to Streaming is high.

So what happens next?

At the end of the day, I expect an arms race whereby the current ToFu offerings (social media, YouTube, FASTs) attempt to “eat” the MoFu offerings, in their quest to offer their massive user bases premium, paid products faster the MoFu offerings can do the opposite. At the end of the day, everyone is playing for the vertically integrated stack of ToFu, MoFu, and BoFu products.

More specifically, I expect:

Streaming companies push more aggressively to integrate FASTs into a single brand & app (e.g. “PlutoTV Free” and “PlutoTV Paid”) and, in a refreshing twist from watching 24/7 Baywatch re-runs, put teasers of premium content on their free services, in an attempt to convert those free users to their paid Streaming services. EG: you can watch the first 3 episodes of the hit new show, or the first quarter of the game, on “PlutoTV Free” but, in order to go further, you must subscribe to the Streaming service, which you can do in just one click.

Companies such as YouTube will continue to push more aggressively to integrate Streaming as a logical MoFu product in their search for higher ARPUs as, with multiple billions of users already on the platform, they begin to exhaust the number of connected humans on the planet. They’ve already made a big bet on NFL Sunday Ticket; who knows what’s next.

The integration point of ToFu and MoFu will become the hot topic of discussion (EG questions like how is our free tier supporting conversion to our paid one?).

The bottom line

As reality comes into focus, the extreme optimists and pessimists, alike, will be proven wrong. No, Streaming is not doomed. And it won’t be the silver bullet, either. Streaming has a very specific (and important) job to do in the new media ecosystem — and it will be flanked on both sides with equally important top and bottom of funnel products.